FREE INFORMATION

Useful snippets of information that, like The Mileage Ace itself, might just help with making the tedious task of tracking your business miles, that little bit easier.

Which Mileage Tracker Is Best For You?

Shopping for a mileage tracker? Read our detailed article about which mileage tracker is the right one for you. We cover the most important things to consider, which most people don't think about. Everything from apps to dedicated mileage trackers, you'll get educated on the subject and it'll help you make the right decision for you and your business.

Current Mileage Rates (2016)

- Business Miles: 54 Cents Per Mile

- Medical or Moving Miles: 23 Cents Per Mile

- Service of Charitable Organizations: 14 Cents Per Mile

IRS MILEAGE LOG REQUIREMENTS

To claim a deduction for transportation expenses related to business, you

must be able to provide the IRS with the exact log of every mile you traveled

during the year. In the event of an audit, the IRS will request a copy of your

mileage log to verify each of your deductions. If you cannot supply this

information, the IRS will require you to submit an amended tax return and

possibly fine you.

Click here to see how much they can fine you

- The Date

- Exact Mileage Driven

- Destination (Address or Name)

- The Purpose Of The Trip

Can I Use A GPS Logging Device To Log My Business Miles?

Here's what the IRS says:

"If you prepare a record in a computer memory device with the aid of a logging program, it is considered an adequate record."

-IRS Publication 463 - How to prove expenses

This is the IRS's way of saying, "ABSO-FRIGGIN-LUTELY!"

The Trouble With Mileage Tracking Apps

If you pull up the App store you'll find a number of apps that claim they can do everything The Mileage Ace does. And why not? Smart phones have GPS and WiFi, so they can do all the same things, right?

Unfortunately no.

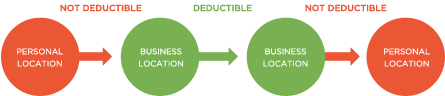

Can I Claim Miles From Home To The Office?

Business miles are always from one business location to another. So if you have a Home Office and can claim the home-office deduction on your taxes, then you absolutely can claim those miles from home! In fact, the main tax advantage to having a home office is that you can claim all your miles from home to any business location.

do the math: how much does a mileage deducton actually make you?

Annual Business Mileage

IRS Mileage rate 56 Cents

IRS Mileage rate 56 Cents

Your % tax rate

in your pocket each year!!

WHAT ARE THE PENALTIES FOR NOT HAVING A MILEAGE LOG?

Very few people actually keep an accurate log of their miles. It's a task that is incredibly easy to forget about in the midst of a busy life. Many people who don't have a log still claim the deduction and simply say something like "80% of my miles were for business." Whether they were or not, without a log this can really come back to bite you.

The IRS penalty for claiming business miles without a mileage log is the greater of $1000 or 50% of your income! So, if you are claiming a mileage deduction but not logging your miles, you could be on the line for a huge penalty. This is enough to make people go bankrupt.

9 LITTLE KNOWN STRATEGIES THAT COULD LEGALLY SAVE YOU THOUSANDS IN TAXES

Income taxes are the single largest expense you'll encounter in life, bigger then your home or the cost of getting your kids to college. Income taxes are the prevalent barrier to real financial security. You can never build any real wealth without first getting your tax life under control. You may have heard the expression "tax freedom day." That's the day when we stop working for the government and begin working for ourselves.

Strategy # 1 - Deduct your job-related auto expenses and/or charitable mileage

When you use your automobile at your employer's request to run job assignments and your employer does not reimburse you...

Read the rest of this article: http://mycpateam.com/free-stuff/9-little-known-strategies-that-could-legally-save-you-thousands-in-taxes/

If I Deduct Actual Expenses Do I Still Need A Mileage Log?

Surprisingly, YES, you do. It has to do with how the IRS will calculate what your vehicle deduction should be:

Actual Expenses X % That Was For Business = Deduction Amount

And how do you think the IRS will calculate the % That Was For Business? They use your mileage log! So whether you claim your miles or your actual expenses, you must have a mileage log in order to prove the percentage you are actually claiming.

Get more useful information like this by following us on Facebook:

The information above is intended as a helpful guideline and may not apply to you personally. Always consult your CPA for any tax-related questions.